NFC mobile payment is a revolutionary technology that allows users to make secure and contactless transactions using their smartphones. NFC has been around since the early 2000s, but it’s only in recent years that mobile payment systems have taken advantage of its capabilities. With NFC wireless payment, users can make purchases without needing cash or a physical payment card, offering a more convenient and secure option. Here we’ll take a closer look at what NFC mobile payment is, how it works, and Reasons for choosing it.

What is NFC Mobile Payment?

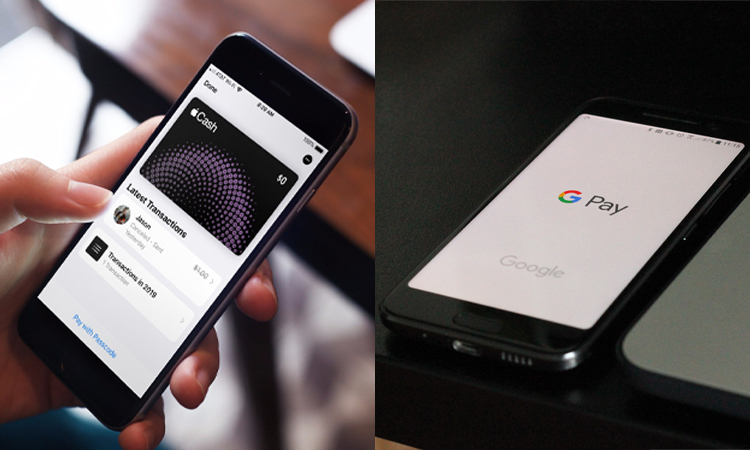

NFC mobile payment refers to using Near Field Communication technology on mobile devices for making secure transactions. NFC-enabled smartphones or smartwatches allow users to make contactless payments simply by tapping their device on an NFC-enabled payment terminal. NFC is a short-range wireless communication technology that enables the exchange of information between devices. NFC for mobile payments is becoming increasingly popular due to its convenience, speed, and security. Major tech companies like Apple, Google, and Samsung have introduced NFC mobile payment services such as Apple Pay, Google Pay, and Samsung Pay. NFC technology is also used for other purposes like sharing photos, videos, and contacts between devices.

The following video describes the risks and opportunities of mobile payment platforms:

What are the Types of NFC Mobile Payments?

NFC mobile payments allow users to purchase by simply tapping their mobile device against a payment terminal. There are different types of NFC mobile payments, including:

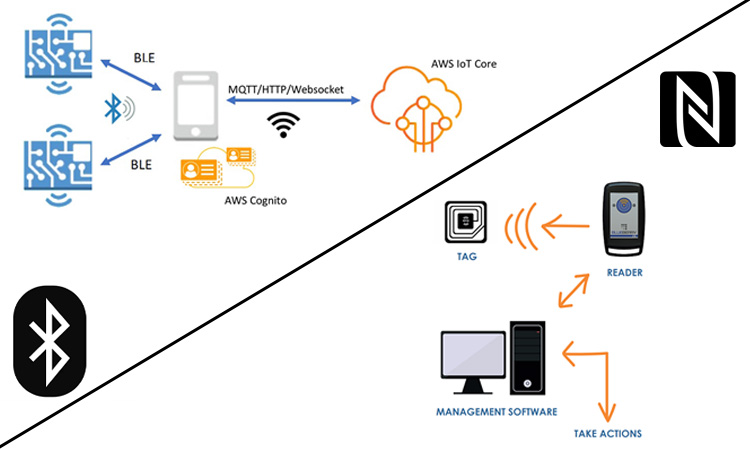

- Card Emulation Mode: Card emulation mode lets users store their payment card information on their mobile devices. When making a payment, the mobile device acts like a physical payment card, transmitting the payment information to the payment terminal using NFC technology.

- Peer-to-Peer Mode: Peer-to-peer mode allows users to transfer funds to other users by tapping their mobile devices together. This method is commonly used for person-to-person transactions, such as splitting a restaurant bill or paying back a friend.

- Tag Mode: Tag mode allows users to make payments by tapping their mobile device against an NFC tag. NFC tags are small, passive devices programmed with payment information. This method is often used for vending machines or other self-service payment systems.

Since NFC payments receive mobile wallets and contactless payments, it is also popular with many businesses.

Devices Compatible with NFC Mobile Payments

NFC mobile payments allow fast and secure transactions by tapping a device against an NFC reader. Here are some devices that support NFC mobile payments:

- Smartphones: Both Android and iOS devices can make mobile payments with NFC technology. Many payment apps, such as Apple Pay and Google Pay, are available for download.

- Smartwatches: Many wearables, including smartwatches, support NFC payments. For example, the Apple and Samsung Galaxy watch have NFC capabilities.

- Tablets: While less common, some tablets also have NFC capabilities and can be used to make mobile payments.

- EMV-chipped credit/debit cards: Today’s most credit and debit cards have EMV chips that support NFC payment technology. These can be tapped against an NFC reader for a contactless transaction.

While NFC payments can be made with various devices, it’s important to check with the payment provider to ensure compatibility with their specific NFC reader.

How does NFC Mobile Payment Work?

Near Field Communication mobile payment mainly completes the entire payment process through the device and the card reader. The payment device is activated due to its proximity to the reader only. At this point, the NFC chip in the payment device exchanges encrypted data with the card reader to complete the payment. The entire checkout process is almost completed in the blink of an eye. NFC for mobile payments are one of the most convenient and secure payment methods. As a result, more consumers choose NFC-powered payment methods such as Apple Pay and Google Pay.

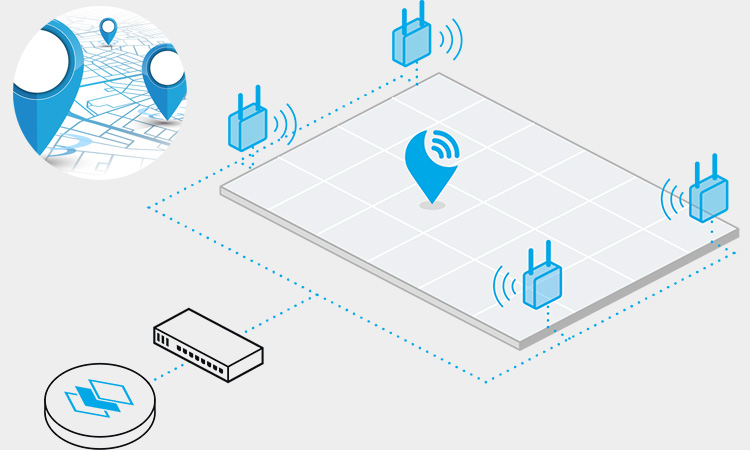

The two devices, the payment device and the card reader are connected by radio waves or contactless. They work very similarly to the radio waves of RFID tags. It is because NFC is an advanced form of RFID technology. The operating frequency used by the NFC chip is one of the fundamental operating frequencies of RFID. This frequency is 13.56 MHz, which only works properly when the chip is very close.

NFC mobile payment technology are quite secure. E-wallets communicate with NFC readers only under certain circumstances. This specific case is when the device’s application is unlocked, and a payment operation is performed. The payment reader can also connect to only one NFC payment device when a transaction is made. It makes it impossible to break in or steal your information.

In addition, consumers can store many credit and debit cards on their mobile devices. It allows consumers to reduce the need for a wallet and the number of cards they carry. It greatly facilitates consumers’ travel.

You can Use NFC Mobile Payments with Contactless Payment Technologies

NFC is similar to RFID and Bluetooth technologies. But they have distinct differences. NFC is limited to sharing data with specific devices over short distances. It does not need discovery or manual synchronization of devices as Bluetooth does, and NFC requires less power than Bluetooth.

Why Choose NFC Mobile Payment?

NFC mobile payment can provide a secure shopping experience for customers. It allows customers to keep social distance and follow hygiene protocols while shopping. Especially at the checkout, there is always a lot of activity between the customer and the sale. Although retailers usually stipulate that employees are sanitized between shoppers. But in real practice, it is usually not done. Using NFC payment terminals requires some physical interaction between employees and customers. But NFC mobile payments technology can give both parties a less-contact and a more secure option.

Contactless payments allow customers to have more payment options. Customers can choose the payment method on their terms. Today many credit and debit cards are also equipped with NFC chips. It allows these cards to have click-to-pay capabilities. Therefore, using the same technology, you can use these credit and debit cards for contactless mobile payments.

In recent years, the popularity of contactless payments of a type like NFC payments has risen dramatically. While the United States had a fairly small penetration in terms of NFC payments back in 2018. Only 3% of cards supported contactless payments at that time. However, there has been a sudden change since March 2019. The use of contactless payments rose by 150%. It is to say nothing of the advent of COVID-19. Since then, customer shopping behavior has changed dramatically. Contactless payments of a type like NFC payments have increased further.

A study was also done by the National Retail Federation (NRF) and Forrester. The study found that by 2020, the number of retailers accepting contactless payments has grown to 58%. In 2019, compared to 2010, there was an increase of 40%. Many more consumers are choosing contactless payments. More than 21 percent of U.S. consumers use contactless payments because of security concerns. And nearly half of consumers also prefer contactless payments due to convenience. They don’t use traditional card transactions.

In addition, the way merchants accept payments is closely tied to the service they provide to their customers. Respecting all payment types helps merchants build loyalty. It can also make the customer shopping experience smooth and convenient from start to finish. Of course, businesses also need to stay up-to-date with the latest POS systems. The latest systems help give customers more confidence that businesses are serious about serving them. Because they can provide customers with high speed and high security.

read more: How to Make Better Use of iPhone NFC?

NFC Mobile Payment Benefits

The benefits of NFC payments for businesses and customers are numerous.

- Simplify the checkout process. According to MasterCard, contactless payments take less time than traditional face-to-face payments.

- Enhance the customer experience. NFC payments help customers have a better, more convenient customer experience. According to statistics, 40% of consumers in the current market use digital wallets for payment. 37% of consumers prefer contactless card payments.

- Improved security of use. Paying with NFC technology offers higher security than swiping a card. In addition, NFC technology can effectively reduce face-to-face credit card fraud.

Potential Drawbacks of NFC Mobile Payments

While NFC mobile payments have numerous benefits, there are also some potential drawbacks to consider:

Compatibility Issues with NFC Mobile Payment

NFC mobile payment is still a relatively new technology, and not all payment terminals are equipped to accept NFC transactions. Some retailers may not have upgraded their payment systems to be compatible with NFC technology, which can limit the places where users can make NFC payments. Additionally, not all smartphones are NFC-enabled, which means some users may be unable to use this payment method.

Security Risks with NFC Mobile Payment

While NFC mobile payment is designed to be secure, there are still potential risks associated with this payment method. One concern is the possibility of hacking or data breaches, as sensitive payment information is transmitted wirelessly between devices. However, many NFC payment systems use encryption and tokenization to protect user data and prevent unauthorized access.

Limitations on Transaction Amounts

Some NFC mobile payment systems limit the money transferred in a single transaction. For example, Apple Pay has a limit of $3,000 per transaction, while Google Pay has a limit of $2,000. While these limits may not be an issue for most users, they could be problematic for those making large purchases.

Dependency on Technology

One potential drawback of NFC wireless payment is that it relies on technology, which can sometimes be unpredictable. If a user’s smartphone battery dies or their device malfunctions, they may be unable to complete an NFC payment. Additionally, if a terminal payment experiences technical difficulties, it could prevent users from making NFC payments.

NFC Mobile Payment Technology Provider

Many providers support NFC wireless payments at this stage. However, most consumers choose a payment provider by the brand of mobile device they own. Of course, you can also choose a digital wallet you use frequently. Here are a few of the most popular NFC mobile payment providers:

- Apple Pay

Apple Pay is popular with most consumers in the United States. According to statistics, there will be 43.9 million users using Apple Pay in the United States in 2021. It is because the iPhone, iPad, and Apple Watch are all pre-installed with Apple Pay, which users can use directly. NFC mobile payment Apple Pay also supports the storage of up to 12 cards. Customers can choose during the payment process.

Apple Pay uses a system called tokenization, which has absolute encryption protection. Even when customers use Apple Pay, they do not have an unencrypted copy of the customer’s payment information. In addition, the combination of Apple Pay and Face ID authentication has long provided perfect security. It makes Apple Pay one of the world’s most secure NFC mobile payment applications.

- Google Pay

Android Pay is the predecessor of Google Pay, which supports use on Android and iOS devices. It is the second-largest digital wallet in the U.S. NFC mobile payment Google Pay has more than 25 million monthly active users in the U.S. alone.

Google Pay also helps customers keep track of their finances. Consumers in the U.S. and India mostly prefer to use Google Pay.

Related Articles: Top 15 NFC Companies

Can I Business Use NFC Mobile Payments?

NFC mobile payments are supported for various types of business use. They have great benefits for both employees and customers of a business. They are especially great for retailers who need to process many daily payments.

Businesses that can use NFC mobile include, but are not limited to:

- Brick-and-mortar retailers: apparel, home furnishings, large appliances, etc.

- Mobile retailers: street vendors, flea market stall operators, and other businesses that need to move around.

- Food Service Businesses: NFC is particularly well suited for these food service businesses. Include the need for frequent, high-volume take-out transactions.

- Fitness and recreation facilities: Some recreation facilities serve individual consumers, including gyms, physical therapists, etc.

- Medical service providers: Therapists, pharmacists, medical-type consultants, and others who provide medical services. They can all get more convenience through NFC.

- Charities and nonprofits: NFC helps process payments for people hosting events or fundraisers who are on the move.

- Professional service providers: Most professional service centers support NFC wireless payments.

NFC mobile payments meet the security standards of employees and customers. It is suitable for any startup or small to the medium-sized retailer.

Related Articles: Website NFC Tag Messages Explained

NFC Mobile Payments FAQs

-

What is NFC mobile payment, and how does it work?

NFC mobile payment is a contactless payment method allowing users to transact using their smartphones. It uses Near Field Communication technology to enable wireless communication between the user’s device and a payment terminal.

-

What are the benefits of using NFC mobile payment?

The benefits of using NFC mobile payment include convenience, security, speed, and contactless payment options.

-

Which retailers and payment systems accept NFC mobile payments?

Many major retailers and payment systems accept NFC mobile payments, including Apple Pay, Google Pay, Samsung Pay, and many others.

-

What are the security risks associated with NFC mobile payment?

Security risks associated with NFC mobile payment include the possibility of hacking, data breaches, and unauthorized access to sensitive payment information.

-

Can NFC mobile payment be used internationally?

Yes, NFC mobile payment can be used internationally, provided that the payment system and payment terminal are compatible.

-

What is the difference between NFC mobile payment and other contactless payment methods?

NFC mobile payment is one type of contactless payment method that uses Near Field Communication technology. Other methods may use different technologies like QR codes or RFID.

-

How does NFC mobile payment compare to traditional payment methods like cash and credit cards?

NFC mobile payment offers many advantages over traditional payment methods. These include faster transactions, more security, and more convenient payment options.

-

What types of smartphones are compatible with NFC mobile payment?

Most newer smartphones are NFC-enabled, but users should check their device’s specifications to confirm compatibility.

-

Is it possible to use NFC mobile payment without an internet connection?

Yes, NFC mobile payment can be used without an internet connection as long as the payment terminal is also offline-capable.

-

What is the future of NFC mobile payment, and how will it continue to evolve?

The future of NFC mobile payment is expected to continue to evolve with new features. Researchers enhancements are being added to improve security, convenience, and user experience.

Video Source: Griffith University