While credit card processing outages are rare, they can be a major inconvenience when they do occur. A processing outage can result in lost revenue for your business, whether it’s due to a power outage, a faulty WiFi connection, or an unexplained system error message on the payment terminal. To avoid this scenario, you must understand why credit card processor outages happen and what you can do to prevent them in the future. While you may not be able to eliminate the risk, taking proactive steps to ensure your payment processing system is stable and reliable can help minimize the impact of any potential outages.

What is a Credit Card Processing Outage?

A payment processor is a system that transmits data from a customer’s credit card to your merchant account. When this system experiences a disruption, it can result in a credit card processing outage that prevents payment. The cause of the disruption can vary, from equipment failure or technical issues on your end to problems with your payment processor or internet provider.

According to a 2021 study by Ponemon Institute, the average cost of a data center outage is $5,600 per minute. Credit card processing outages can have a significant impact on businesses. This can lead to lost sales, damage to reputation, and decreased customer loyalty.

As a business owner, it’s important to be prepared for the possibility of a processing outage and have a plan to troubleshoot and resolve any issues that arise quickly. By taking proactive steps to ensure the reliability and stability of your payment processing system, you can minimize the risk of an outage and protect your business from lost revenue.

How do Credit Card Processing Outages Occur?

Credit card processing outages can occur due to a variety of reasons. For example:

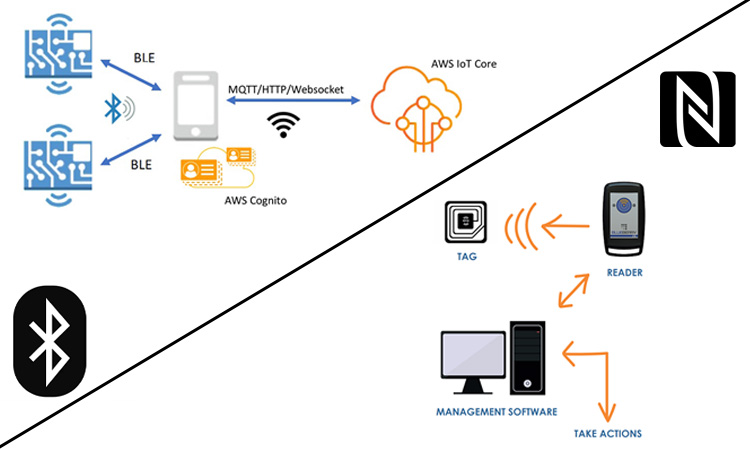

- Technical issues, such as software glitches or hardware failures.

- Network problems, including connectivity issues or cyberattacks. It can also cause outages.

- Human error, such as misconfiguration or incorrect settings. It can also be a factor.

- Cyberattacks and security breaches are also potential causes of credit card processing outages. Hackers can disrupt systems or steal sensitive data.

- Unexpected spikes in transaction volume or changes to payment processing regulations can cause processing delays or outages.

According to a 2021 report by IBM, the average time to identify and contain a data breach is 287 days, highlighting the impact of security-related outages. In order to prevent and solve credit card processing outages, you need robust systems to identify them. This addresses potential issues before they become major problems. Regular maintenance and testing can help detect and address technical issues, while security protocols can prevent network-related outages.

What should I do During a Credit Card Processing Interruption?

During a credit card processing outage, you can take several steps to minimize the impact on your operations.

- The first step is communicating with customers and informing them of the issue. This can include posting notices at the point of sale or on the business’s website. You can offer alternative payment methods, such as cash or checks, if possible.

- In the event of a cyberattack or security breach, you should contact law enforcement and take steps to protect your data and systems from further harm.

- Ensuring that any transactions not processed during the outage are recorded and reconciled later is essential.

- Additionally, you should contact your payment processing provider to report the outage and get updates on the issue’s status.

- Finally, you should take steps to prevent future outages by identifying the root cause of the outage and implementing measures to address it.

By being prepared and taking appropriate action, you can minimize the impact of credit card processing outages on your operations and maintain customer satisfaction.

How to Solve Credit Card Processing Outage

Solving credit card processing outages requires quick and effective action.

- The first step is to identify the cause of the outage, such as a software bug or hardware failure. You need to take appropriate measures to address it. This can include rebooting equipment, restoring backups, or replacing faulty hardware.

- In the case of a cyberattack or security breach, you should take steps to contain the attack. Such as disconnecting affected systems from the network.

- Additionally, you should keep customers informed of the status of the outage and any alternative payment methods available.

- Document any transactions not processed during the outage and reconcile them later.

How to Prevent Credit Card Processing Outages

Preventing credit card processing outages requires a proactive approach. Here are some tips to prevent credit card processing interruptions:

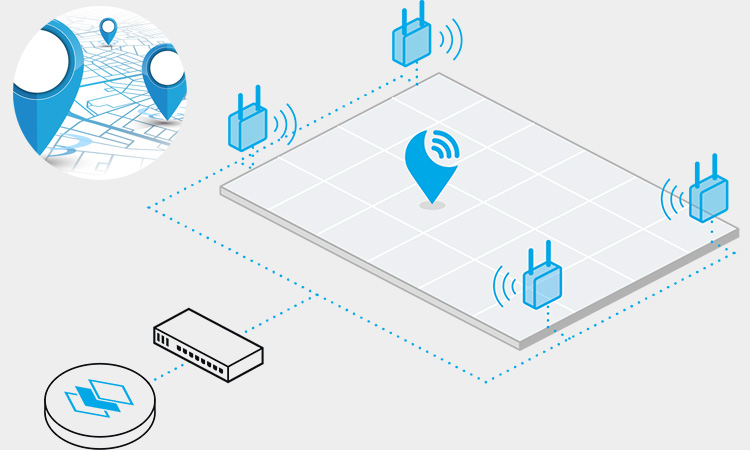

- One way to prevent outages is to invest in reliable hardware and software. This includes using high-quality payment terminals, servers, and payment processing software.

- Regularly updating software and security protocols can also help prevent outages caused by software bugs or security breaches.

- Regularly monitoring network traffic and promptly addressing any anomalies can help prevent outages caused by network issues.

- You can also implement redundant systems and backup power sources to ensure operations can continue even during a power outage.

- Training employees on security protocols and proper equipment handling can also help prevent outages caused by human error.

You can ensure uninterrupted payment processing and maintain customer satisfaction by taking proactive measures to prevent credit card processing outages.

How a Credit Card Outage Affects Businesses

The impact of a credit card processing outage can vary depending on the nature of your business. At a minimum, it can be an inconvenience that disrupts normal operations and negatively affects the customer experience. For small business owners, turning away interested customers or operating as a cash-only business during an outage can be frustrating and limit potential revenue. To minimize the impact of a processing outage, you need to have backup equipment and contingencies in place.

While you can’t always control when and how network failures or power outages occur, being prepared can help you find workarounds and maintain business operations during this time. Doing so ensures you don’t miss out on potential revenue and maintain a positive customer experience even during an outage.

Credit card processing outages can have significant impacts on businesses and customers. While preventing such outages is ideal, having a plan in place for how to respond during an outage can help cut disruption and prevent long-term negative effects. By understanding the possible causes of credit card processing outages and taking steps to prevent and address issues, businesses, and customers can help ensure a smooth and secure payment experience.

Related Articles: How To Accept Credit Card Payments Without A Merchant Account

About Credit Card Processing Problems Today

-

What does It Mean When a Credit and Processor Issue has Occurred?

When a credit card processor issue occurs, there is a problem with the system that processes credit card transactions. This can result in declined transactions, delayed processing times, or complete payment processing outages. A variety of factors can cause these issues. This includes hardware or software malfunctions, cyberattacks, or network connectivity problems. You may need to work with your payment processor or technical support teams to diagnose and resolve the issue. They also may need to implement contingency plans to continue processing payments while the issue is being addressed.

-

Why are Credit Cards not Processing?

Credit cards may not be processed for various reasons, such as insufficient funds, incorrect billing information, expiration, technical issues, or security concerns. Another possible cause is a temporary hold on the card due to suspicious activity or fraud prevention measures. Customers need to contact their bank or credit card issuer to resolve any issues with their cards. You should also communicate any problems with your payment processing systems to their customers.

-

Why do Credit Card Purchases Take so Long to Process?

Credit card purchases can take longer to process for several reasons, including network delays, technical issues, or security checks. Transactions may also be subject to additional verification steps, such as address verification or fraud detection, which can prolong the processing time. Some merchants may have longer processing times due to their specific payment processing systems or policies. Additionally, the time and day of the week can impact processing times, as peak periods may result in longer wait times for transactions to be processed. Overall, credit card processing times can vary based on various factors. You need to have efficient and reliable payment processing systems in place to minimize delays and ensure a positive customer experience.

-

Why is my Credit Card Transaction Declined for Security Reasons?

A credit card transaction may be declined for security reasons if the payment processor or credit card issuer detects potentially fraudulent activity or a suspicious transaction. In such cases, the transaction is declined to protect the cardholder’s account from unauthorized access or fraud. Some common reasons for security-related declines include exceeding daily or transaction limits, entering incorrect card information, or purchasing from high-risk merchants or countries. Cardholders can contact their issuer to inquire about the specific reason for the declined transaction and take steps to address any issues or concerns. Additional verification steps or security measures may be required before the transaction can be approved.

-

Why has My Credit Card Payment Failed?

There are several reasons why a credit card payment may fail, including insufficient funds, an expired card, or a mistake in entering the card information or billing address. Other factors contributing to a failed payment include technical issues with the merchant’s payment processing system or a network outage. Customers can resolve the issue by checking their account balance, ensuring that their card information is up-to-date, and contacting the merchant or card issuer to identify and resolve any issues with the payment.